It is typical to be required to submit a cancelled cheque as part of the application procedure when opening a bank account or applying for different financial services. If you are confused that How to Write HDFC Cancelled Cheque then this guide is for you. Simply put, a cancelled cheque is one that the account holder has decided not to honour and cannot be used to withdraw funds or make payments. The writing of an HDFC cancelled cheque and the justifications for its necessity will be the main topics of this analysis. First, let’s know what is cancelled cheque is:

What has HDFC cancelled Cheque?

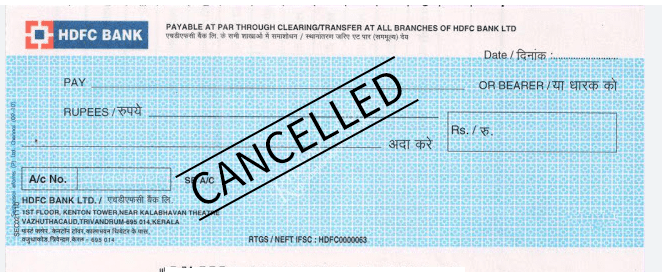

A cheque marked as cancelled by the account holder of an HDFC bank account is known as an HDFC cancelled cheque. The word “cancelled” is often printed in huge letters across the cheque’s face, and two parallel lines may also be put across the cheque to indicate that it cannot be paid. When setting up electronic payment systems like Electronic Clearing Service (ECS) or Automated Clearing House (ACH) payments or for account verification, many financial institutions frequently need HDFC cancelled cheques. Use a pen with permanent ink when writing an HDFC cancelled cheque, make sure the cheque is not folded or crumpled, and include the account holder’s name, account number, and MICR. Check HDFC Bank Balance from here.

Why Do We Need To Write HDFC Cancelled Cheque?

There are a number of situations where a bank may ask for a cancelled cheque. Account verification is one of the primary motives. The bank can confirm the accuracy of the account holder’s name, account number, and MICR code by receiving a voided cheque, which lowers the possibility of any problems occurring during financial transactions. Moreover, a cancelled cheque can be used to set up electronic fund transfers like the Automated Clearing House (ACH) and the Electronic Clearing Service (ECS), which are ways of moving money from one account to another electronically.

How To Write HDFC Cancelled Cheque?

Follow these steps to write an HDFC cancelled cheque:

Step 1: Pick a cheque from your chequebook that is connected to your HDFC account as your first step. Check to make sure the cheque is not expired or postdated.

Step 2: To indicate that the cheque cannot be cashed, cross it with two parallel lines.

Step 3: Write “Cancelled” in big letters over the cheque’s face. Indicating that the cheque is no longer valid in this way helps to make it apparent.

Step 4: Submit the cancelled cheque to the appropriate institution or organization.

HDFC Bank Cancelled Cheque Sample:

Composing Guidelines for an HDFC Cancelled Cheque:

- The cheque should be written using a pen with permanent ink.

- The cheque should not be folded, creased, or ripped in any manner.

- To indicate that the cheque is no longer valid, write “Cancelled” in big letters.

- Verify that the cheque is neither stale-dated nor postdated.

What is the Difference Between a Cancelled Cheque And a Normal Cheque?

The primary distinction between a cancelled cheque and a normal cheque is that a cancelled cheque cannot be cashed or used to make a payment, whereas a normal cheque can be cashed or put into a bank account.

Some other differences:

- A cancelled cheque is used for account verification, such as when setting up electronic payments or confirming bank account information. In contrast, a normal cheque transfers payments to another individual or organization.

- A cancelled cheque will have the term “Cancelled” printed in huge letters across the face of the check, as well as two parallel lines are drawn across the cheque. A normal cheque contains no particular markings.

- A cancelled cheque is no longer an acceptable form of payment and cannot be cashed or placed into a bank account. A normal cheque, on the other hand, is a genuine payment instrument that can be cashed or placed into a bank account as long as it is not post-dated or expired.

- A cancelled cheque is often less secure than a regular cheque because it has been used and contains information about the account holder’s bank account. A standard cheque, on the other hand, should be kept safe to prevent fraud or unauthorized access to the account holder’s cash.

When a Cancelled Cheque is Required?

A cancelled cheque is often required for a variety of financial transactions, such as:

- Electronic Clearing Service (ECS): In order to validate bank account information while setting up ECS for automatic bill payment, the service provider may request a cancelled cheque.

- Direct debit: When setting up a direct debit payment option, some organizations, such as insurance companies or mutual funds, may request a cancelled cheque to verify bank account information.

- Credit card: When applying for a credit card, the bank may request a cancelled cheque to confirm the applicant’s bank account information for automatic payments.

- Investment accounts: When establishing an investment account or withdrawing funds from an investment account, investment firms may request a cancelled cheque to verify bank account information.

- Salary accounts: Employers may request a cancelled cheque from employees in order to establish direct deposit into a pay account.

- Loan accounts: When establishing a loan account or withdrawing funds from a loan account, banks and other financial institutions may request a cancelled cheque to verify bank account information.

FAQ’s

Do we need to sign the HDFC cancelled cheque?

No, you don’t have to sign an HDFC cancelled cheque. The cheque only has to have two parallel lines drawn across it, with the phrase “Cancelled” written in between. A cancelled cheque does not require your signature.

Can a post-dated cheque be used as a cancelled cheque?

No, you cannot use a postdated cheque as a cancelled cheque. It is essential to choose a cheque that is neither postdated nor expired.

What information should be included on a cancelled cheque?

The account holder’s name, account number, and MICR code should be printed or handwritten on a cancelled cheque.

Also Check: How to download interest certificate from HDFC Bank?

Conclusion

While applying for a variety of financial services, it is customary to provide a cancelled cheque. Crossing the cheque, writing “Cancelled” across the face of the cheque, signing it, and sending it to the appropriate institution or organization constitutes a basic procedure to write HDFC cancelled cheque. It is essential to adhere to the aforementioned guidelines to ensure that the cancelled cheque is properly filled out and fits the requirements for account verification and electronic payment arrangements.