Obtaining an interest certificate from HDFC Bank is an easy process. The interest certificate is a document that shows the interest earned on your deposits in the bank for a specific financial year. The certificate is an important document that is required for tax filing purposes. In this article, we will discuss the step-by-step process of how to download interest certificate from HDFC Bank. Whether you are a salaried individual or a business owner, this guide will be helpful for anyone who needs to download an interest certificate for HDFC Bank.

The process of downloading an interest certificate from HDFC Bank can be done through the bank’s official website. It is a quick process that just takes a few minutes to finish. The interest certificate is available for download in PDF format, which makes it simple to save, print, and distribute.

In this guide, we will walk you through the process of downloading the interest certificate, step by step. We will also provide you with the necessary documents and information that you will need to complete the process. So, let’s get started.

How To Download Interest Certificate From HDFC Bank?

You can download your Interest Certificate by 2 easy methods:

- Through Net Banking

- Through Mobile App

Download Interest Certificate Through NetBanking:

Follow these easy steps to download your Interest Certificate by NetBanking.

- Visit the official website of HDFC Bank Net Banking- HDFC NetBanking Login

- Login to your Net Banking Account with the help of your Customer ID and Password.

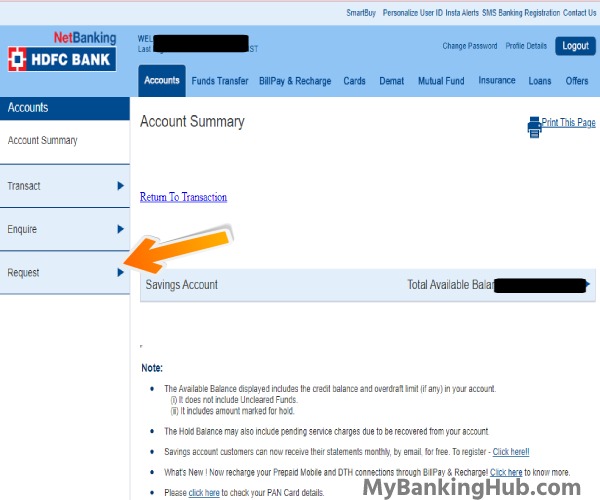

- Once you log in to your account, click on the “Request” option from the right-side menu.

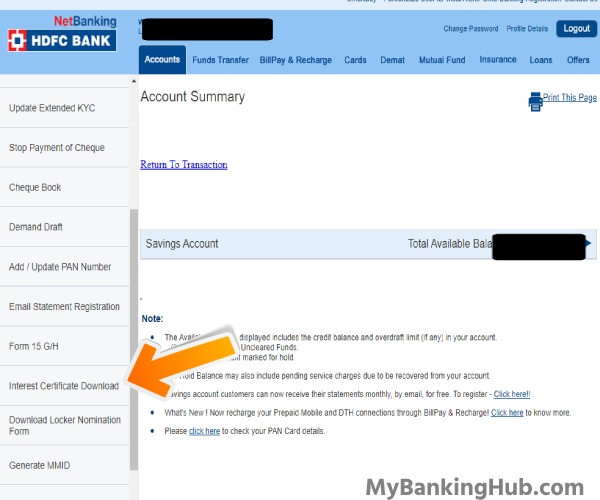

- Now, from the list of different services, click on the “Download Interest Certificate”

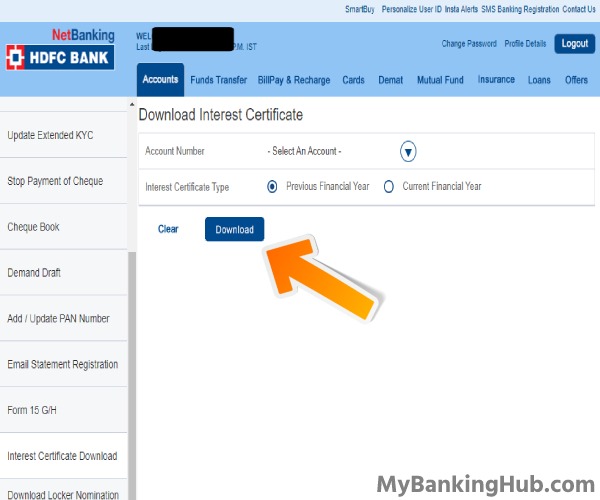

- On the new page select your account number and then select the financial year to download the Interest Certificate.

- Click on the download button and the HDFC interest certificate for that year will be downloaded on your mobile or PC.

How To download HDFC Interest Certificate Using Mobile App:

Let’s see how you can download your interest certificate via HDFC Mobile App:-

Firstly, download the HDFC MobileBanking App: Download From Here

- Log in with your Customer ID, Password and OTP received to your mobile number.

- Tap on the menu icon, given at the top of the left corner.

- Now, visit “Your Profile” > “Tax”.

- On the new page, select Know Taxes Paid or Deducted.

- Now select the financial year to download the Interest Certificate.

- And tap on the download button and the interest certificate will be downloaded to your mobile.

Why Should You Download an Interest Certificate?

An interest certificate is a document that shows the interest earned on your deposits in the bank for a specific financial year. It is an important document that is required for tax filing purposes. Obtaining an interest certificate from HDFC Bank is an easy process that can be done through the bank’s official website or mobile app. In this article, we will discuss the reasons why you should download an interest certificate from HDFC Bank.

- Tax Filing: The interest certificate is a crucial document that is required for tax filing purposes. It is proof of the interest earned on your deposits in the bank during the financial year. The income tax department uses this certificate to calculate the tax liability of an individual or business. Without this certificate, you may have to pay a higher amount of tax or face penalties for not providing the correct information.

- Claiming Tax Benefits: If you have invested in fixed deposits or other tax-saving schemes, you can claim tax benefits on the interest earned. The interest certificate is required to claim the tax benefits. It shows the details of the interest earned on your investments and helps you to claim the tax benefits.

- Auditing: If you are a business owner, you may need to produce the interest certificate during an audit. The interest certificate provides a record of the interest earned on your business deposits in the bank. It is an important document that is required to reconcile bank statements and balance sheets.

- Planning for the Future: Knowing the interest earned on your deposits in the bank can help you plan for the future. You can use the information in the interest certificate to compare the interest rates offered by different banks and choose the one that offers the best rate. This can help you to make informed decisions about where to invest your money.

As mentioned in the above points, it is a crucial document that is required for tax filing purposes, claiming tax benefits, and auditing. The process of downloading the certificate is easy and can be done through the bank’s official website or mobile app. It is a valuable tool that can help you to plan for the future and make informed decisions about your finances.

Read More: How can I activate HDFC SMS Banking?

Video Tutorial

Conclusion

Finally, obtaining an interest certificate from HDFC Bank is a straightforward procedure that can be done through the bank’s official website or mobile application. Whether you are a salaried individual or a business owner, the step-by-step guide provided in this article will be helpful for anyone who needs to download interest certificate from HDFC Bank.

The interest certificate is an important document required for tax filing purposes, and the process of downloading it only takes a few minutes to complete. By following the instructions outlined in this guide, you will be able to easily download your HDFC Bank interest certificate and use it for tax filing or other purposes.